One of the branches of State-owned Punjab National Bank (PNB) has recently detected fraudulent transactions worth over Rs 11,000 crores.

WHAT IS LETTER OF UNDERSTANDING (LOUS)?

LoU is an assurance given by one bank to another to meet a liability on behalf of a customer.It is similair to a letter of credit or a guarantee.It is used for overseas import remittances and involves four parties — an issuing bank, a receiving bank, an importer and a beneficiary entity overseas.According to norms, they are usually valid for 180 days.LoUs are conveyed from bank to bank through “Society for Worldwide Interbank Financial Telecommunication” (SWIFT) instructions.Notably, till now, there is no record of a breach in SWIFT instructions anywhere in the world.

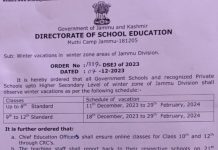

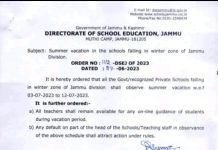

WHAT HAS HAPPENED WITH PNB?

PNB has alleged that two of its employees had “fraudulently” issued LoUs and transmitted SWIFT instructions to the overseas branches of Indian Banks.This was done to raise buyer’s credit for the firm of a diamond merchant without making entries in the bank system.The bank has alleged that one such fraudulent LoU issuance took place on January 2018, the trail of which revealed the entire design.These LoUs were mostly issued to two Hong Kong branches of Indian Banks and was for the aforesaid diamond merchant.The details on whether LoUs were backed by collateral or the quantum of liability that the bank faces against these LoUs aren’t out yet.

HOW WILL THE FRAUD IMPACT PNB?

Hong Kong branches of Allahabad Bank and Axis Bank have given money to the beneficiary entity on behalf of Modi’s firms.As a result, PNB will have to settle the LoUs with these branches according to the norms of the Hong Kong Monetary Authority.Market sentiment has already been impacted and PNB stock fell 9.81% in a single day, which consequently saw investors loose over Rs 3,000 crores.The bank may have to set aside higher provisioning in the next few quarters if it unable to recover the money from the accused firms.The fraud has been unearthed at a time when Indian banks are reeling under a pile of stressed assets of about Rs 10 lakh crore.Also, higher provisioning and a rise in bond yields, has resulted in losses for most public sector banks in the previous quarter.

WHY IN NEWS?

One of the branches of State-owned Punjab National Bank (PNB) has recently detected fraudulent transactions worth over Rs 11,000 crores.

WHAT ARE ITS IMPLICATIONS ON PNB?

For India’s second largest bank to be defrauded in the manner suggested is astounding, especially since regulatory oversight has tightened in recent years.Notably, the mounting stressed asserts has led to greater scrutiny of account books by – bank’s audit committees and boards, as well as the central bank.The government, had recently unveiled a plan to infuse about Rs. 1 lakh crore into 21 capital-starved pu blic sector banks this fiscal (recapitalisation).Of this, Rs. 5,473 crore is to be injected into PNB, which currently looks dwarfed in comparison to the amount that was swindled in the current scam.Hence, despite the proposed infusion, the capital adequacy ratio of PNB is expected to worsen due to the fraudulent leakage.Notably, PNB’s market capitalisation has dropped by Rs. 8,077 crore over the past two days, with the share price falling over 20% since the news broke.

HOW HAVE THE VARIOUS STAKEHOLDER REACTED?

The bank’s top brass has suspending around 10 officials and the CBI has booked one retired and one serving PNB employee so far.The bank has claimed that regulatory lapses are being probed, as a handful of junior employees couldn’t have orchestrated such a massive fraud singularly.Enforcement Directorate has initiated a money laundering case against the main accused, billionaire-jeweller Nirav Modi, and his aides.Notably, the firms run by him had seen a meteoric rise and an IPO was also in the offing soon.

WHAT IS THE WAY FORWARD?

PNB has sought to blame overseas branches of other banks for not undertaking due diligence before accepting such transactions.But that may be too simplistic an explanation and an inquiry by the RBI must get to the bottom of the systemic lapses to fix accountability across the sector.While the banker-borrower nexus has plagued the banking system for years, this episode exposed that the nexus is a lot deeper than imagined.RBI and investigating agencies should act speedily to restore trust in the banking system in particular and also the larger financial setup.